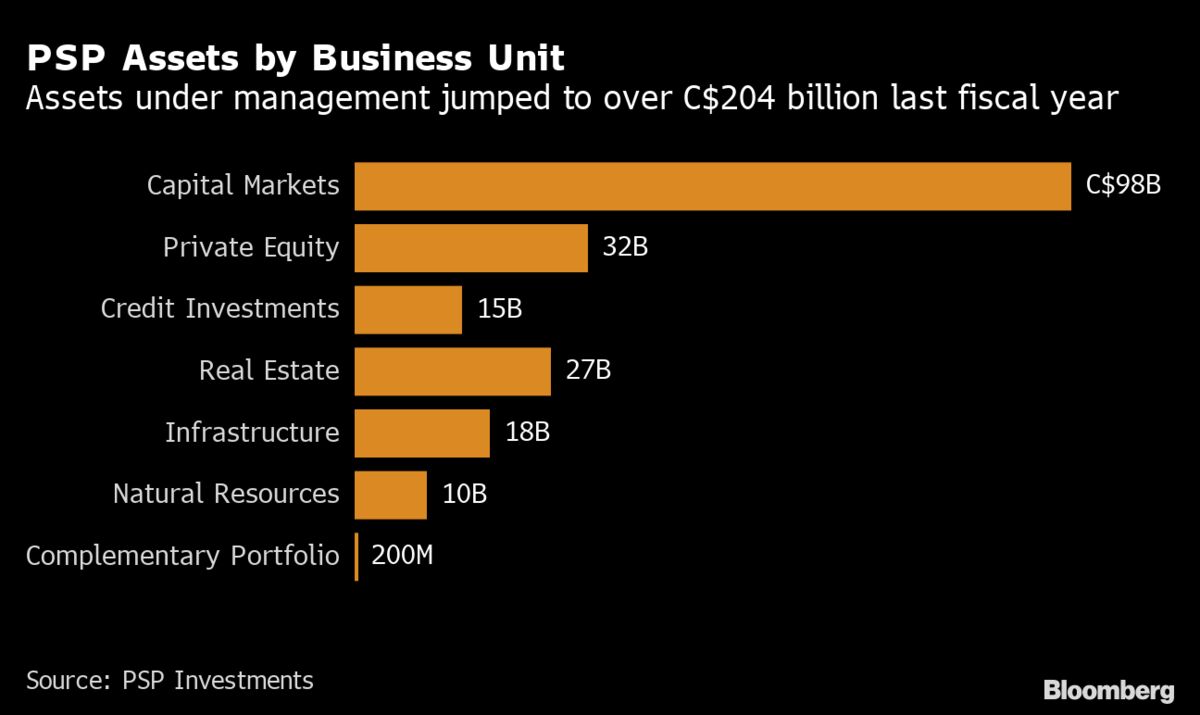

PSP Investments Posts 18.4% Return in Fiscal Year 2021 and Surpasses $200 Billion in Assets Under Management

PSP Investments Posts 10.7% 10-Year Annualized Rate of Return as Net Assets Under Management Grow by 9.7% to $168 Billion in Fiscal Year 2019

Aviva Investors and PSP investments to improve sustainability credentials of Soho office building - Aviva Investors

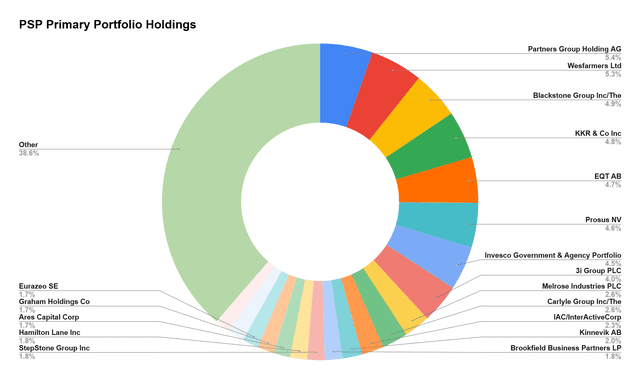

PSP: Check This ETF Out If You Want Diversified Private Equity Exposure (NYSEARCA:PSP) | Seeking Alpha